Alset Insurance launches as embedded auto insurance MGA start-up on Incline paper

Alset Insurance launches as embedded auto insurance MGA start-up on Incline paper

Former Tesla insurance chief Matt Edmonds has launched a digital-first auto MGA initially writing on the paper of Incline Insurance that has ambitious plans to revolutionise the segment by providing near frictionless coverage integrated seamlessly with carmakers and dealerships at the point of sale, The Insurer can reveal.

Through this partnership with Tekion, dealers can now connect Alset Insurance with Tekion’s Automotive Retail Cloud (ARC), seamlessly, in real-time, making data sharing faster and easier than ever. Alset Insurance’s embedded digital-first platform enables OEMs and dealerships to provide insurance policies directly to consumers. Alset Insurance enables dealers to provide customers a highly customized insurance policy in less than a minute.

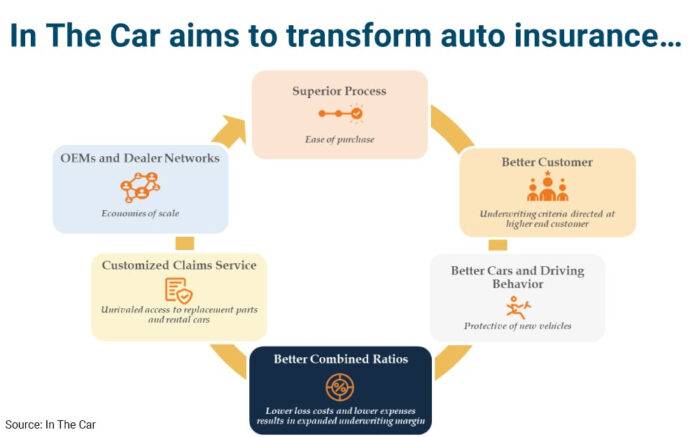

In a statement confirming the launch of Alset Insurance, the start-up said it aims to transform the auto insurance landscape with its “cutting-edge, digital-first platform” allowing car buyers to finalise their vehicle purchase and insurance coverage in a “single, seamless transaction”.

President and CEO Edmonds previously led the development and launch of Tesla Insurance Services for the Elon Musk-led electric vehicle manufacturer after building a career at carriers including AIG and Allstate.

Talking to this publication about the opportunity ahead of Alset Insurance, the executive said that carriers have tried for years to work with manufacturers and dealership management systems (DMS).

But he said that insurance has been left behind as the car buying process has continued to evolve.

“Consumers want convenience and transparency – they don’t want to spend hours waiting for insurance quotes. With Alset Insurance, they can get a fully customized, competitively priced policy in 30 seconds or less. No waiting. No complexity. Just a better experience,” the executive continued.

He suggested that based on the market opportunity Alset Insurance could grow to in excess of $400mn of premium within a few years.

The Stamford, Connecticut-headquartered firm has already entered into a partnership with a top-three US auto manufacturer and directly integrated with a number of what it describes as industry-leading dealer management systems.

These include Tekion, DealerTrack, RouteOne and CDK.

Alset Insurance claimed its approach will allow manufacturers and dealerships to offer well-qualified drivers with strong credit and a clean driving history insurance rates at up to 20 percent lower.

The MGA said that while legacy auto insurers spend billions a year on marketing costs that are passed onto consumers, Alset Insurance is eliminating these “costly ad campaigns” and instead passing savings on to insurance buyers.

Soft Launch

The start-up has begun underwriting policies as part of a soft launch of an auto insurance product designed for a specific so-called original equipment manufacturer (OEM) that is one of the largest in the US.

The product is written on the AM Best A- paper of hybrid fronting carrier Incline Insurance and its affiliate Redpoint Insurance Group, which provides coverage in Texas.

Working with reinsurance intermediary Howden Re on the launch of the program, Alset Insurance has secured reinsurance capacity to support the offering with a panel of highly rated global reinsurers.

According to its website, it has also partnered with Crawford as its claims TPA, and technology firm PurpleBox, among others.

It is currently able to quote and write policies in three states in its launch phase, with a number of other states set to go live in the coming months as it continues to file with regulators to expand its footprint.

The MGA is understood to be in talks with a number of other carriers about potential partnerships, including by bringing their products onto its platform to broaden its offering.

Edmonds told this publication that the rapid speed for Alset Insurance to deliver policies is based on data mining and modelling to support the underwriting process.

The MGA uses data collected during the vehicle sale and financing process – including prior insurance coverage and driving history – to instantly generate tailored “competitively priced” insurance policies.

Alset Insurance said that its partnership with a top 3 US manufacturer has already demonstrated the “transformative power” of its platform, with nearly 50 percent of car buyers requesting insurance quotes and almost 20 percent moving forward with the customized policies that were generated for them.

“Alset Insurance doesn’t just save time – it redefines the entire car-buying process,” said Edmonds.

“We’re giving consumers a complete understanding of their total cost of ownership from the start, combining both car price and insurance premium into a single, transparent package. This makes the car-buying experience faster, easier, and far more efficient,” he continued.

Alset Insurance is backed by seasoned entrepreneurial industry figures including Rod Fox and Jim Standard as investors.

Fox – currently executive chairman of Howden Re and also managing partner of investment firm F&S Ventures – is chairman of the start-up, according to its website.

Former Endurance, Marsh & McLennan Capital, Conning & Co and AIG executive Win Hotchkiss is executive vice president and director, while Leonard Oremland, managing director at investment firm Xponance, is also a director.

Senior management at the MGA – which has subsidiary operations including Alset Insurance Services – include vice president of product Caitlin Mahoney, previously of Farmers; vice president of operations Laura Crabill, who is a former director of product at Munich Re Digital Partners and worked with Edmonds at Tesla; former Allstate and CDK/Salty executive Jenny Johnston as head of agency; seasoned technology executive Nihat Guven as CTO; and Anna Kokkinos as chief of staff.